With the Mobile World Congress on in Barcelona, Spain, the question is begging to be asked – is the wearable devices space the next big opportunity for sensor manufacturers after the dream run of smartphones and Tablets has run its course?

With the Mobile World Congress on in Barcelona, Spain, the question is begging to be asked – is the wearable devices space the next big opportunity for sensor manufacturers after the dream run of smartphones and Tablets has run its course?

Two major reports by leading research firms that analysed how this market behaved in 2014 seem to think so. One of them was by Frost & Sullivan – Wearable Electronics Enabled by Sensors – which had even concluded that the sensor landscape for wearable devices would “soon gain a new dimension” through the entry of software and hardware giants such as Google, Apple, Samsung and Intel.

The Frost & Sullivan team was of the opinion that the sensors market, which had earned revenues of US $108 million in 2014, would catapult to US $800 million in 2020.

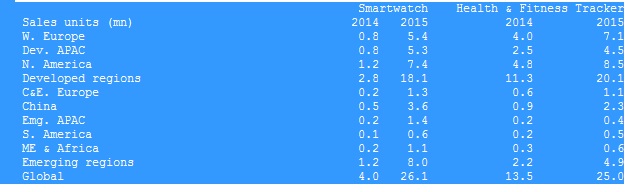

Another study conducted late 2014 by the fourth largest market research firm in the world, the Germany-headquartered GfK showed that 13.5 million health and fitness trackers (HFT) were sold globally last year, compared to the 4.1 million smartwatches in the same period. With major companies expected to enter the market this year, GfK has predicted that the combined market would leap to 51.2 million sales in 2015, which was three times the size of 2014 – with both segments showing equal importance in this converging market.

“Rising average life expectancy and increasing awareness on health and fitness monitoring have fuelled the adoption of wearable devices,” said Frost & Sullivan Measurement and Instrumentation Senior Industry Analyst Sankara Narayanan, in his report. “In addition to clinical healthcare, medical, fitness & wellness applications, the wearables market is witnessing a series of new product launches, such as Heads-up Displays, smart watches, smart fabrics, wrist bands, and glasses that are used across various consumer, industrial and other verticals. As the need to collect various physiological data and quantified self-movement surges, wearables will incorporate more complex electronics and sensors.”

The Frost & Sullivan team expected that sensor platforms, rather than sensor components, would play a critical role in wearable device innovation and shortening time to market. “Sensor platforms fill the software-hardware knowledge gap, enabling rapid prototyping of wearables and helping wearable designers do their own hardware design,” added Narayanan.

The Wearable Electronics Enabled by Sensors report was part of the Sensors & Instrumentation Growth Partnership Service program.

The increase in fitness wearables, said the GfK study, was, in part, driven by the “significantly lower average sales price” of HFT, making these devices more affordable than full-feature smartwatches. Another reason for the higher popularity of HFT (according to a GfK survey of 5000 smartphone owners across five countries) was the fact that a majority of consumers saw activity tracking as being the most important function of a wearable – including a smartwatch – at the present time.

Dr Jan Wassmann, Global Product Manager for Wearables at GfK, said in a written statement, “Many consumers are not yet aware of the additional benefits a smartwatch has to offer. We believe this will now change, driven by the marketing efforts of the industry this year. Added to this, there is a clear convergence of both segments, which started in the second half of 2014 – and we see this driving market growth. HFT manufacturers are introducing new models which incorporate smart functions, such as reading notifications and messages. And many new smartwatches now come with heart rate sensors and activity tracking capabilities and are being marketed as hybrid fitness devices.”

GfK expected the smartwatch market, in particular, to grow massively, boosted also by a growing sub-segment of independent devices with include a SIM card to connect directly to cellular networks – making these more akin to existing smart phones. GfK’s survey found that over half (56 percent) of smartphone owners interviewed across five countries saw this as an important capability that made them more likely to buy a smartwatch, as it gave them the freedom to leave their smartphones at home. In addition, wearable growth was also likely to be driven by more fashionable designed devices (e.g. analogue smartwatches) or sensors included in jewelry, which will be more appealing to female consumers – an important segment which has remained almost untapped so far.

The GfK study also established that for now, the biggest contribution to these global volumes was coming from the “developed regions.

Although Western European markets, like many other regions, had not seen the expected uptake for the first three quarters of 2014, volumes had spiked in the fourth quarter – driven by strong holiday sales and new model launches by known manufacturers. In Europe’s biggest markets, Germany, Great Britain and France, actual sales in Q4 had accounted for 36 percent of the total volume sold in 2014. This clearly showed that wearables were a popular gift during the holiday season.

Going by these two research reports and analysis, it is clear that the outlook for 2015 for wearable devices does seem positive.

Image Credit: GfK +Blackberry. Sales Graphics by: GfK

– Advertising Message –